32+ Payback period calculator online

A PbP of 425 indicates that the break-even would be achieved at the end of the first quarter in year 4. From that we can.

Lean Six Sigma Project Coaching Program Business Performance Improvement Bpi

The length of time YearsMonths needed to recover the initial capital back from an investment is called the.

. Bleeding and discharge of. It is the time period where the investment cash outflow starts recovering from. It is an investment appraisal technique that determines the.

Where NPV value is equal to zero. The Payback period is an indicator of the repayment characteristics of an investment. Online finance calculator which helps to calculate the required payback period to repay the annual finance or investment in the capital budgeting.

The payback period is the time it takes a business to recover its investment in a project. A period a commonly used term for referring to menstruation is a womans regular discharge of blood and mucosal tissue that occurs as part of the menstrual cycle. Calculator for Payback Period.

The total value of the investment into the fund over a specific period in this Discounted Payback Period DPP calculator the period being one year. By Gary Jeffrey - Last Updated. The PbP is calculated on an intra-period basis eg.

Our discounted payback period calculator calculates the discount cash flow accurately and provides you with the complete cash flow in the form of table. The formula for the calculations. It is the sum of the total investment and the annual cash flow.

It basically answers the question of how long it takes for the investment to amortize. If the discount rate is 10 then we can calculate the DPP. Here is how the.

The DCF for each period is calculated as follows - we multiply the actual cash flows with the PV factor. For instance if you have made an investment of 100 and it has. So the formula for calculating IRR is same as NPV.

Payback Period Calculator Payback period is a simple technique for measuring the investment appraisal. The Payback Period Calculator calculates the total time period in which a project repays its initial investment. This payback period calculator solves the amount of time it takes to receive money back from an investment.

C refers to the. Initial Investment Amount Rslbs. If the PBP is 4 for.

Step by Step Procedures to Calculate Payback Period in Excel. PP refers to the payback period in Years I refers to the sum that you have invested. The payback period is the amount of time it takes to recoup the investment.

Where in the above formula. Payback Period Calculator. To use this online calculator for Discounted Payback Period enter Initial Investment Initial Invt Discount Rate r Periodic Cash Flow PCF and hit the calculate button.

CF Cash Flow. NCF Net Cash Flow. PP I C.

Our tutorial on the payback period method gives full details about how to calculate and. IRR or internal rate of return is calculated in terms of NPV or net present value. The payback period refers to the time required for reaching break-even point for your investment depending on your cash flow.

La Calculadora Me Gusta Marca Texas Instruments Calculator Calculator Design Financial Calculator

Top Solar Companies Solarsesame

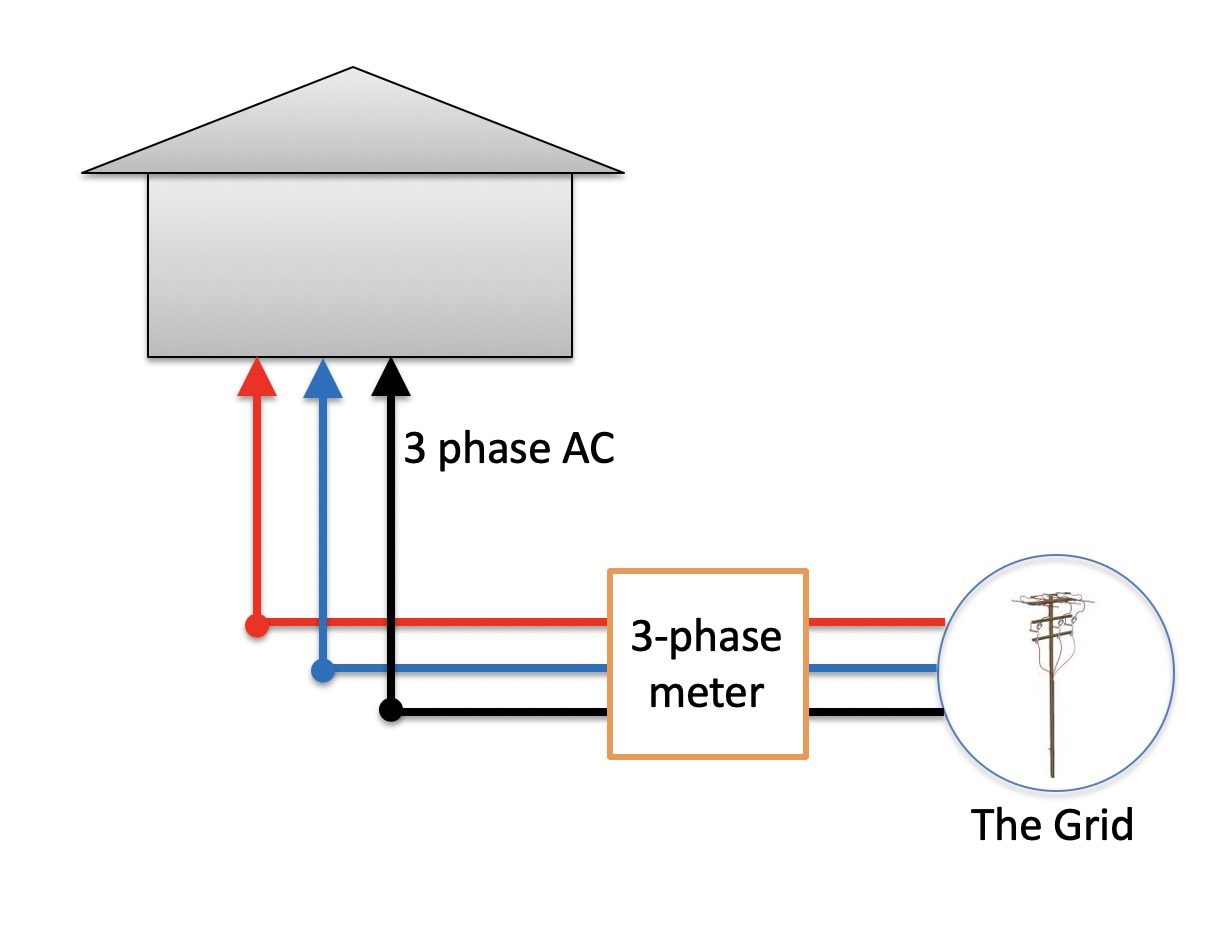

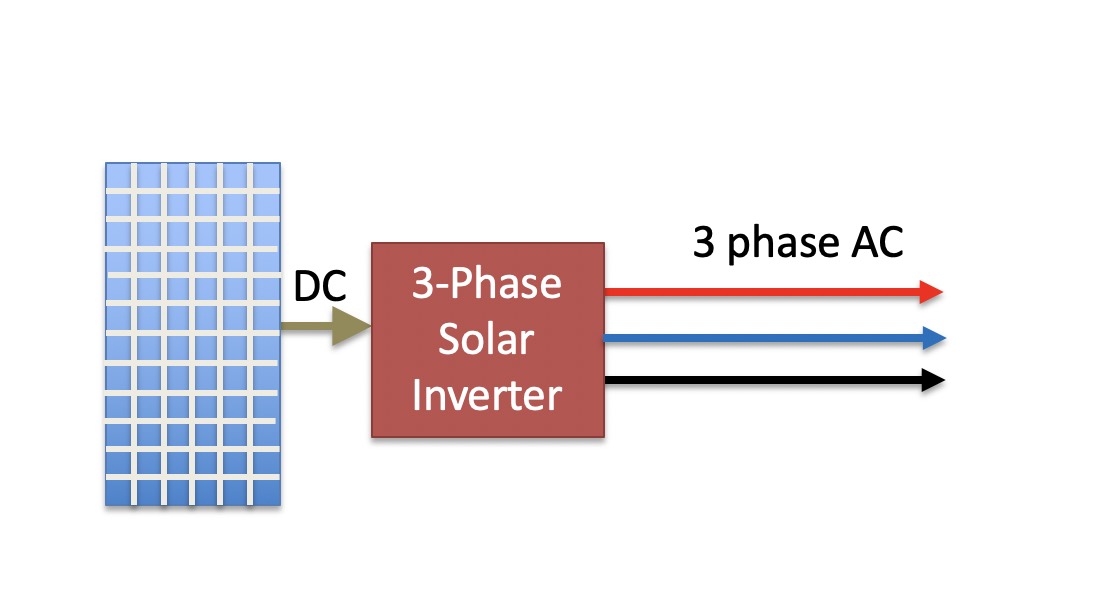

Should You Get A Three Phase Solar Inverter Solarquotes Blog

Should You Get A Three Phase Solar Inverter Solarquotes Blog

2

2

Rule 1 Investing Spreadsheet Download Spreadsheet Spreadsheet Template Investing

2

2

Texas Instruments Baii Plus Calculator

How Internal Rate Of Return Irr And Mirr Compare Returns To Costs Investment Analysis Investing Analysis

Find Break Even Point Volume In 5 Steps From Costs And Revenues Analysis Graphing Good Essay

Payback Period Calculator Double Entry Bookkeeping Payback Period Calculator

2

2

Simple Payback Calculator How To Calculate The Payback Time Of An Investment How To Make A Simple Payback Calculator In Templates Payback Business Template

Payback Period Metric Defined Calculated Shorter Pb Preferred Payback Period Metric